Maximizing Growth in an Ever-Evolving Environment

Banks face dual pressures: retaining deposits while meeting customer expectations in a competitive market. Recent shifts in the macroeconomic environment, including a rate cut by the Federal Reserve, are adding new complexities. While the rate cut will stimulate growth in lending and credit, it also intensifies margin pressures as banks must balance lower borrowing costs with maintaining deposit rates.

Additionally, banks must keep pace with evolving technologies, sophisticated fraud, and cyber-attacks. The rise of Fintech intensifies competition, pushing traditional banks to adapt and innovate.

Revolutionize your banking operations with custom solutions, BPaaS delivery models, and services crafted through innovative design thinking and our user experience labs. With cutting-edge technology and industry-certified experts, we have delivered exceptional results and experiences for over 80 financial services companies.

With NPS of 70+ we have helped 82+ banking and financial services companies across the globe to reinvent and transform their business processes

Transactions and digital interactions

Payments processed

Collections achieved

Average TCO reduction delivered

Turn-around time reduction in banking back office

Accuracy through digital and automation

Segments We Serve

Leveraging deep domain, marketing-leading technology, and our advanced products and platforms, we drive measurable outcomes across various banking industry sectors.

Consumer Lending

We keep customers at the core. Modernize consumer lending with efficient and nimble digital solutions from originations to collections.

- Originations

- UW

- Funding

- Servicing

- Repayment and closures

- Collections

Digital Engineering Services Focus for Consumer Lending

- Intuitive, omnichannel interfaces and tailored platforms for seamless loan origination

- Advanced analytics for risk assessment and personalized lending offers

Customer Examples

- Top 20 US bank by asset size

- Leading US-based MNC specializing in auto finance & leasing, with $115B+ in managed assets

Retail Banking

Deliver exceptional experiences, and create exponential brand value.

Streamline retail banking operations with our AI-driven BPaaS modular solutions, developed in partnership with a digital core banking cloud-native platform.

- Originations

- Compliance

- Payments

- Fraud and disputes

- Servicing

- Settlements and reconciliations

Digital Engineering Services Focus for Retail Banking

- User-centric mobile apps and web banking interfaces driving superior digital experiences.

- Agile, microservices-based banking platforms that support rapid innovation and new product launches

- Real-time analytics and hyper-automation for personalized insights, efficiency and fraud detection

Customer Examples

- Top 10 US bank by asset size

- Leading US bank specialized in consumer lending

Cards

Elevate customer engagement by leveraging digital solutions, domain expertise, and market-leading technology to reimagine the end-to-end lifecycle of cards.

- Originations

- Servicing

- Dispute and chargeback management

- Fraud management

- Compliance

- Collections

Digital Engineering Services Focus for Cards

- Real-time data analytics for fraud detection, customer segmentation, and targeted promotions

- Implement secure continuous integration and automated deployment methods (DevSecOps) for faster time-to-market of new features and services, keeping issuers ahead of market demands.

- Implement comprehensive, automated testing frameworks for card management and payment processing systems

Customer Examples

- Leading US bank specializing in credit cards

- Leading provider of non-prime cards and financing solutions

Payments

Eliminate friction from the payments lifecycle with advanced technologies, innovative AI-powered solutions, and business process excellence. Adopt a digital-first strategy to attain sustainable efficiencies, deliver personalized experiences, and ensure fully compliant payments operations.

- Payments set-up

- Payments processing and repairs

- Transaction monitoring

- Customer service

- Settlement and reconciliation

Digital Engineering Services Focus for Payments

- Support building of robust integrations with payment gateways and processing systems.

- Architect highly available, scalable poly-cloud environments to support global payment operations, ensuring reliability and performance at scale.

Customer Examples

- Global payments and remittances company

Fintechs

From cutting-edge digital solutions for optimizing operations and delivering superior customer experience to regulatory compliance, we provide fintechs with the tools and expertise needed to thrive in today’s digital economy.

- Onboarding and set-up

- Payments, fraud, and compliance

- Account maintenance servicing

- Customer experience & collections

- Enterprise functions (e.g., F&A, HR)

Digital Engineering Services Focus for Fintechs

- Develop scalable, API-first financial applications that enable rapid integration and ecosystem expansion

- Advanced analytics and machine learning solutions for personalized financial services and risk management

- Continuous delivery and secure software deployment (DevSecOps) to enable faster innovation cycles and reduced time-to-market.

Customer Examples

- Top 25 US financial holding company

- Leading financial services technology company in US

Capital Markets

Digital solutions for capital markets that fuel growth, enhance regulatory compliance, and elevate client experiences.

- Client selection and onboarding

- Coverage and sales

- Portfolio management and execution

- Investment ops

- Servicing and risk management

Digital Engineering Services Focus for Capital Markets

- Custom engineering support for high-performance trading systems, risk management tools, and portfolio analytics platforms

- Implement real-time data processing and analytics capabilities for market insights and algorithmic trading

- Design secure, compliant cloud environments that support high-frequency trading and big data analytics

Customer Examples

- Leading US company offering broad range of investment products

Commercial Banking

Whether it’s optimizing lending operations, expanding market reach, or navigating regulatory compliance, we empower SMBs and commercial entities to achieve their strategic objectives and deliver exceptional value to their clients, across the loan lifecycle.

- Prospecting and originations

- Credit appraisal

- Facility set-up

- Servicing

- Collections

- Compliance

Digital Engineering Services Focus for Commercial Banking

- Create intuitive, feature-rich digital banking platforms for corporate clients and SMBs, improving client satisfaction and operational efficiency.

- Advanced analytics for credit risk assessment, fraud detection, and personalized financial insights

- Develop and maintain bespoke cloud-native treasury and cash management systems with integrated, automated security and compliance testing, ensuring reliable, compliant operations.

Customer Examples

- Leading US microfinance company

Our BPaaS Offerings

Delivering outcomes and bring best-of-breed technology and partnerships for the BFS industry.

Solve complex banking challenges from advisory to implementation and hypercare with intelligent automation solutions.

<strong>Sutherland FinTelligent</strong>A suite of flexible, digital-led modular solutions tailored for Fintechs.

<strong><strong>Sutherland FinXelerate</strong></strong>Turning compliance challenges into business value through an end-to-end KYC and AML compliance solution.

<strong>Sutherland AML</strong>Create the perfect synergy of people, processes, and platforms to transform customer service and drive exceptional customer experiences across channels.

<strong>CCaaS</strong>End-to-end core banking solution in BPaaS model, covering core banking system, digital channels, customer management, product configuration and management, multi-cloud deployment, managed services, transition support, and integration services.

Platforms

Powering innovation for your digital transformation journey

Omnichannel customer experience platform

Sutherland Connect<strong>®</strong>Innovative hyperautomation platform, with intelligent workflow, custom rule management, intelligent automation, and ML models

Robility<strong>®</strong>AI-powered end-to-end quality engineering platform

<strong>Cloudtestr</strong>Digitization@Source, with advanced NLP, ML, and OCR capabilities

ExtractAI-based customer interaction analytics platform

Sutherland CX360<strong>™</strong>Workforce security designed for the new normal

Sutherland <strong>Sentinel AI<strong>®</strong></strong>Proprietary collections analytics platform, with AI and ML capabilities to predict delinquency and improve collections

NLP-based embedded translation platform for digital channels

Sutherland Translate AI<em>®</em>Proprietary solution for IT service management, with remote diagnosis and solution recommendation for cyber risk protection

Smartleap<strong>®</strong> HelpTreeA platform solution for remote workforce integration

Sutherland Anywhere®Transform your F&A processes with an end-to-end finance digitization platform

<strong>Prodigy</strong>AI-augmented analytics and integrated transactional desktop solution

Our own proprietary single platform for quality, coaching, and performance to better support internal and external clients and enhance the end-user experience.

Address Your Fintech Operational Challenges and Unlock New Scaling Opportunities

Accelerate Transformation with End-to-End Digital Engineering Solutions

Define

Strategy Blueprint

Revamp business with profound industry and technological expertise.

Design

Reimagined Experiences

Create superior experiences using a multi-lens world view.

Develop

Tailored Solutions

Build disruptive custom tech and data platforms to unlock insights.

Deploy

Market-Leading Tech

Swiftly deploy and harness bespoke technology solutions.

Drive

Innovation at Scale

Manage and optimize enterprise systems and apps at scale.

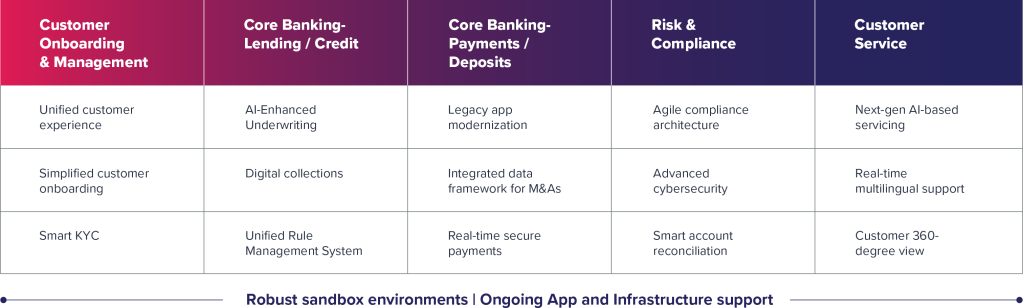

High-Impact Digital Engineering Use Cases

Our Partners

Recognized by Those in the Know

Unlocking Digital Performance

Trusted Partner to Global Brands

82+ clients across 20+ delivery locations with 17k+ skilled domain experts. 70+ NPS delivered. We are trusted transformation partners to iconic brands worldwide.

Outcome-Based Partnership Model

70% outcome-based contracts. With our industry-leading shared success partnership model, we win when you win.

Advanced Capabilities

Leverage our market-leading capabilities in AI, intelligent automation, advanced analytics, and cloud engineering through tailored models that suit your needs.